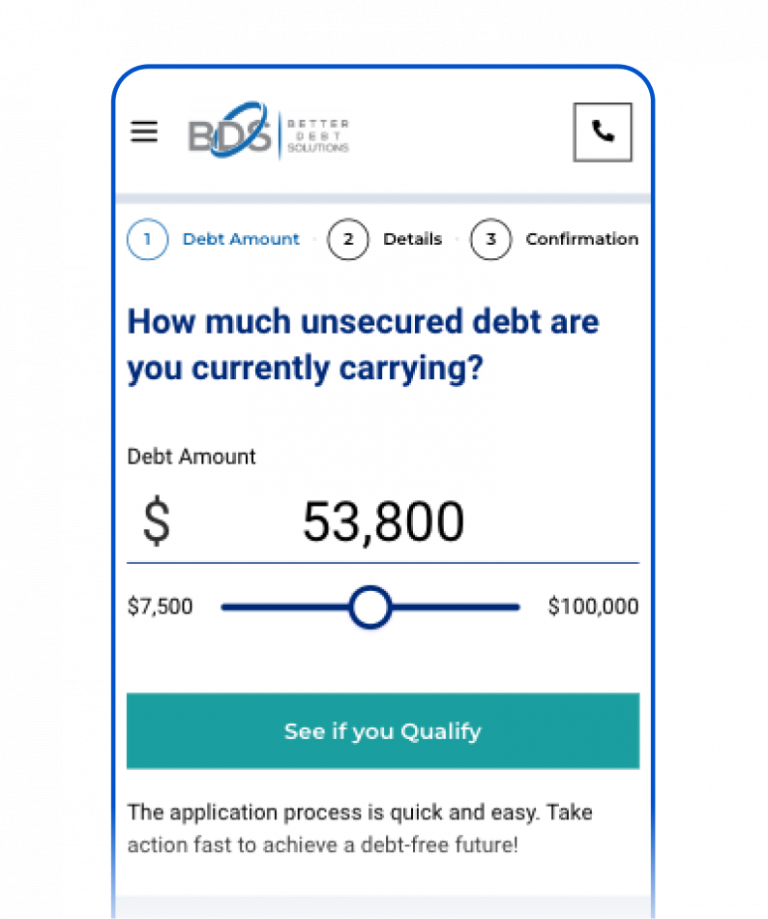

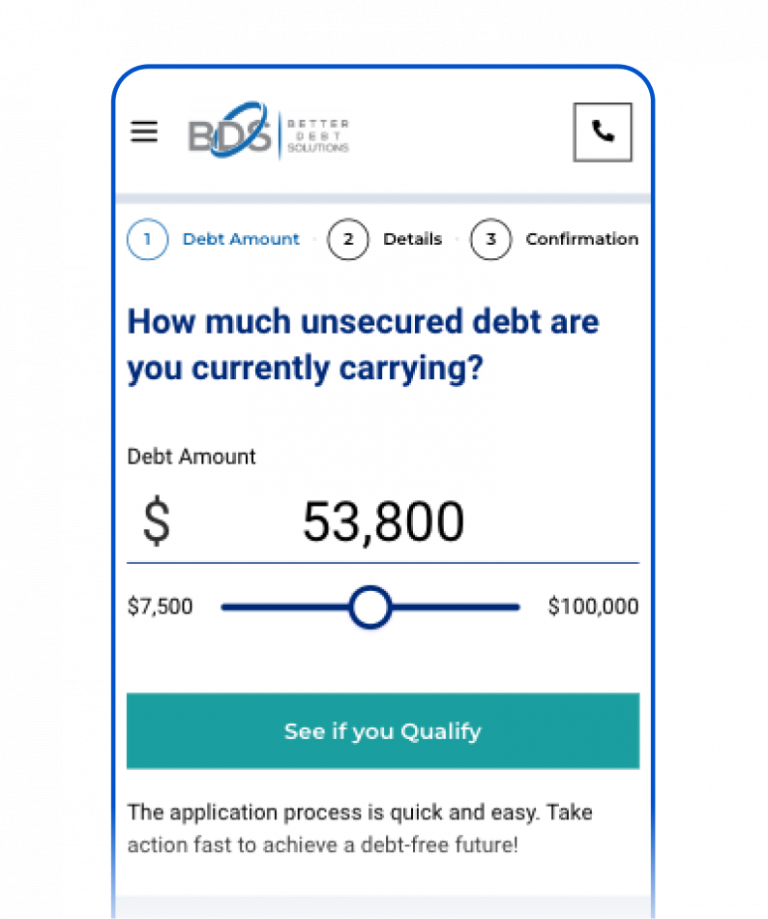

The application process is quick and easy. Take action fast to achieve a debt-free future!

Secured Better Debt Solutions uses 256 bit encryption to secure your information.

We offer expert guidance to manage and alleviate financial burdens with tailored solutions for financial independence.

Complete the form and engage in a call to evaluate your specific situation and find a custom solution.

Once enrolled with one of our trusted partners, deposit regularly into a specialized savings account, reducing your monthly commitments compared to existing credit card dues.

One of our senior advisors will guide you through all the details and work with our expert partners to tirelessly negotiate and reduce your debt, helping you regain financial freedom.

Your financial freedom is our ultimate goal.

Here’s how we ensure it:

Get informed on ALL your options before making any life changing financial decisions.

See if settling unsecured debts, like credit card balances, for less than owed is best for you.

Consider debt consolidation, but let's discuss options for the best plan.

Get financial help tailored to your needs. Contact our representatives.

In a performance-based debt settlement fee structure, the debt settlement company charges a fee based on a percentage of the amount of debt that they can settle for the client. This means the fee is only charged if and when the company successfully negotiates a settlement with the creditor.

Everything is built into your one lower monthly payment in the plan.

The time it takes to settle a debt through debt settlement can vary depending on several factors, including the amount of debt, the creditor, and the negotiation process. In general, debt settlement can take about 24 to 48 months.

During the debt settlement process, the debtor typically stops making payments to the creditor and instead saves money in a separate account for the settlement. This can take several months or longer, depending on how much the debtor can save each month.

Once there is enough money saved for a settlement offer, the negotiation process begins. This can involve back-and-forth communication between the debtor and creditor, with each party making counteroffers until an agreement is reached.

The length of the negotiation process can vary depending on the creditor and the complexity of the debt. Some creditors may be more willing to negotiate than others, and some debts may require more extensive negotiations than others.

Once an agreement is reached, the debtor typically has to make a lump sum payment to the creditor to settle the debt. This can take some time to arrange, but once the payment is made, the debt is considered settled.

In summary, debt settlement can take several months to a few years to complete, depending on several factors. It’s important for debtors to be patient and persistent during the negotiation process and to work with a reputable debt settlement company or attorney to help navigate the process.

Debt settlement companies typically notify clients of a settlement through written communication, such as email or regular mail. The company will provide a settlement agreement offer outlining the settlement terms, including the amount to be paid and any other conditions or requirements.

It’s important for clients to carefully review the settlement agreement and ensure that they understand the terms and conditions before agreeing to the settlement. Clients should also confirm that the settlement amount is accurate and that they can make the required payment.

Yes, creditors are required to stop contacting you once a debt is paid off or settled through debt settlement. Once a creditor has received the agreed-upon payment, they cannot continue to pursue the debt or harass you with calls or letters.

You can contact a Client Services Representative any time during business hours for an update. Our staff will be happy to provide you with an update on negotiations with each of your creditors and the current balance within your escrow account. Or, you can log on to the client portal to review all the activity on your account 24/7.

The online portal! Once logged in, clients can view their account information, including the status of each enrolled debt, the amount owed, and any settlements or payments made. The portal may also provide a timeline of the debt settlement process, outlining the steps involved and the expected timeframe for each stage.

In addition to tracking progress, our partner’s online portal may also allow clients to communicate with their debt settlement company, by sending messages or uploading documents. This can help streamline the communication process and ensure that clients have easy access to important information related to their debt settlement program.

Overall, an online portal can provide clients with a convenient and transparent way to track the progress of their debt settlement program. By providing access to real-time account information and allowing for easy communication with the debt settlement company, an online portal can help clients stay informed and engaged throughout the debt settlement process.

Get your financial freedom back and have a new beginning.

Call us Now: (866) 606-6413

Office Hours

Monday – Friday: 7:00 AM – 7:00 PM PST

Saturday: 8:00 AM – 4:00 PM PST

Debt Management Services

Resources

Privacy

Copyright © 2024 Better Debt Solutions, LLC. All rights reserved.

This company does not actually provide any debt settlement, debt consolidation, or other credit counseling services. We ONLY refer you to companies that want to provide some or all of those services. On average, consumers who successfully complete a debt relief program see average savings of 40% to 60% of their enrolled debt load before program fees. Program fees are calculated based on a percentage of your enrolled debt and typically range from 14% to 27%. Programs are not available in all states, and fees may vary by state. Programs typically run from 24 to 48 months, depending on a consumer’s debt load and individual circumstances. Consumers must save at least 25% of the total amount of each enrolled debt before a debt relief company can make a bona fide settlement offer to a consumer’s creditors. Settlements typically occur every 3 to 6 months, with clients receiving their first settlement within 4 to 7 months of enrollment. Although we cannot guarantee specific results, we work closely with consumers to ensure they are connected with a debt relief provider that can achieve their best possible outcomes. We do not assume clients’ debts, make monthly payments to creditors, or provide tax, bankruptcy, accounting, legal advice, or credit repair services. Please contact a tax professional to discuss the tax consequences of debt relief and a bankruptcy attorney for more information on bankruptcy. Please note that using debt resolution services will likely have an adverse effect on your credit, and you may face collections or lawsuits from creditors or collectors. Additionally, your outstanding debt may increase due to the accrual of fees and interest. Before enrolling, it is essential to read and understand all of your program terms, conditions, and materials. Please note that certain types of debts may not be eligible for enrollment. Also, some creditors may not be eligible for enrollment because they do not negotiate with debt relief companies. Better Debt Solutions, LLC (2525 Main Street Suite 500, Irvine, CA 92614) is accredited by the Better Business Bureau. Contact us today to learn more about how we can help you achieve financial freedom.