Home » About

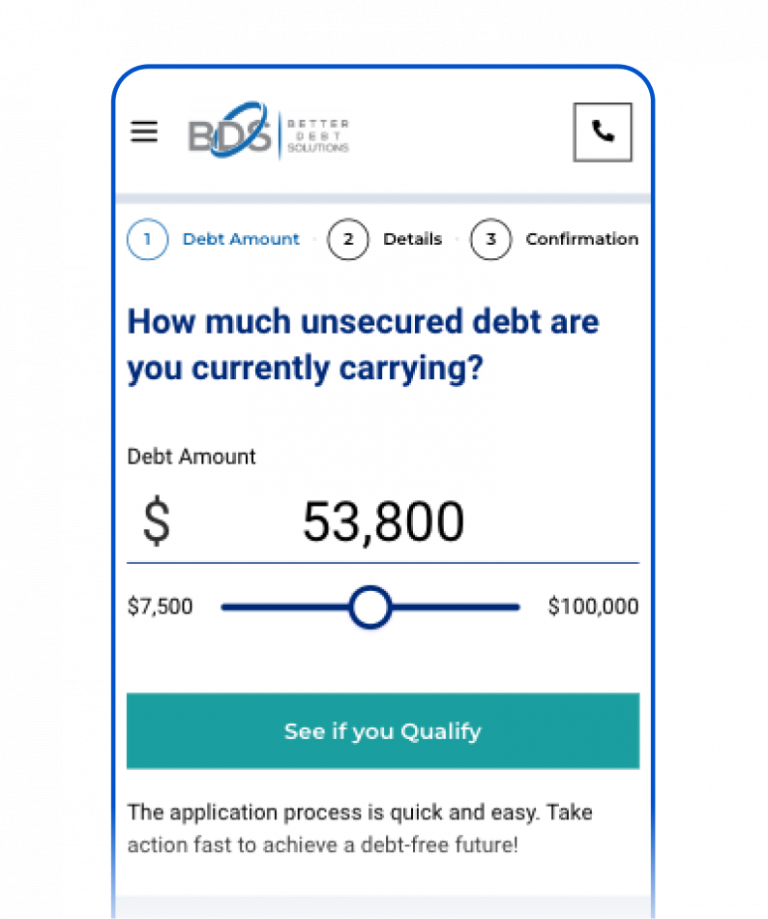

Better Debt Solutions offers debt relief solutions to numerous households and individuals across the United States. As a modernized debt relief enterprise, we have an exclusive platform intended to aid clients in attaining a speedy resolution to their debt. We collaborate with you to establish a plan for achieving a debt-free existence. Discover how Better Debt Solutions can reduce the weight of your financial obligations today!

Our mission is simple: To offer families and individuals struggling with debt in the United States options for debt relief and savings.

We connect our clients with customized solutions to lower their unsecured debt, thanks to our years of experience in the financial services and debt reduction industries. By offering specialized programs and directions throughout their debt reduction journey, we work to aid others in regaining control over their money.

Get your financial freedom back and have a new beginning.

Call us Now: (866) 606-6413

Office Hours

Monday – Friday: 7:00 AM – 7:00 PM PST

Saturday: 8:00 AM – 4:00 PM PST

Debt Management Services

Resources

Privacy

Copyright © 2024 Better Debt Solutions, LLC. All rights reserved.