Managing multiple debts can feel overwhelming, especially when interest rates keep rising and monthly payments barely reduce balances. This is where structured debt management solutions play a critical role. Instead of juggling several due dates and creditors, the right plan helps simplify repayment and restore financial control.

For individuals struggling with unsecured debt, a clear and organized approach can make a significant difference. Whether you live in Texas, California, or elsewhere, a well-designed plan supported by Better Debt Solutions can help you move toward a debt-free future with confidence.

What Are Debt Management Solutions?

Debt management solutions are structured programs designed to help individuals repay unsecured debts in an organized and affordable way. These solutions focus on combining multiple debts into a single monthly payment while working with creditors to reduce interest rates and fees.

A key part of this process is enrolling in a debt managemnet plan, which prioritizes repayment without taking on new loans. Instead of increasing debt, the plan restructures what you already owe, making it easier to manage over time with guidance from experienced providers like Better Debt Solutions.

How a Debt Management Plan Works

A debt managemnet plan consolidates eligible debts into one monthly payment based on your budget. Creditors may agree to lower interest rates or waive penalties, allowing more of your payment to go toward reducing the principal balance.

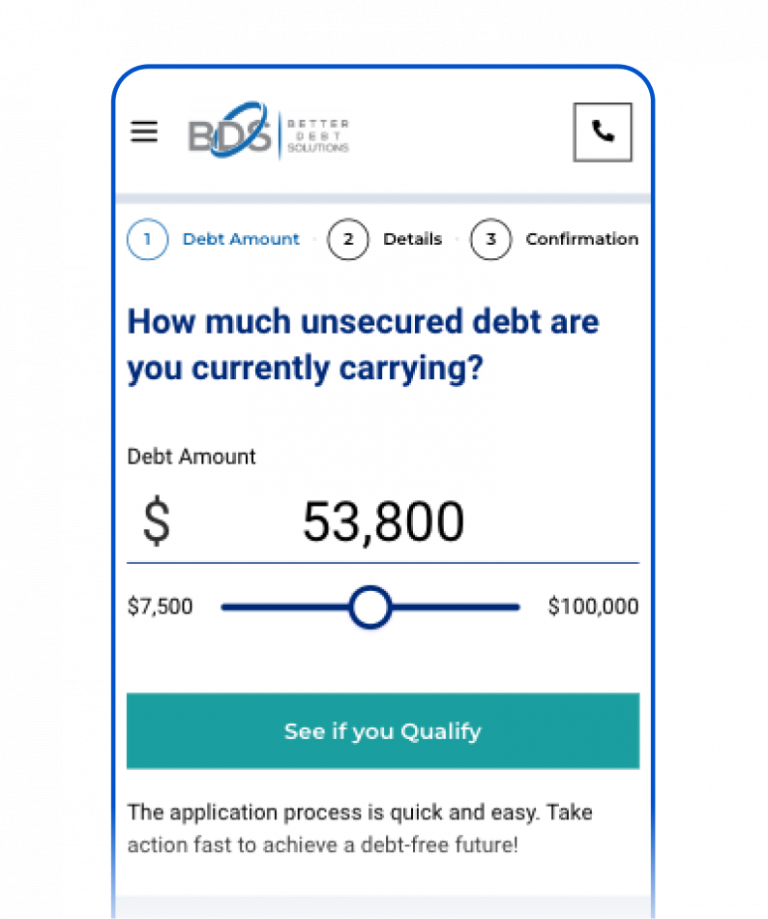

To estimate affordability, many individuals use a debt managemnet plan calculator before enrolling. This tool helps you understand potential monthly payments and how long it may take to become debt-free under a structured plan.

Benefits of Choosing the Right Debt Management Plan

Choosing the right plan offers more than just payment simplicity. It provides structure, accountability, and a clear timeline for repayment.

Key benefits include:

- Simplified monthly payments

- Reduced interest rates and fees

- A clear repayment timeline

- Improved budgeting and financial discipline

- Less stress from creditor communication

When supported by professional debt management services, these benefits help individuals stay consistent and focused throughout the repayment process.

Who Can Benefit from Debt Management Services?

Debt management services are ideal for individuals who are making regular payments but not seeing balances decrease. High-interest credit cards, personal loans, and medical bills are common candidates for structured repayment.

People searching for the best debt management companies often want reliable guidance, transparent processes, and long-term results. This approach is especially helpful for residents in high-cost states like California or fast-growing regions such as Texas, where managing expenses can be challenging.

How to Identify the Best Debt Management Companies

Finding the best debt management companies involves looking beyond promises of quick fixes. Reputable providers focus on realistic outcomes, clear communication, and customized plans based on your financial situation.

Strong companies offering debt management solutions will review income, expenses, and debts before recommending a plan. They also provide ongoing support, helping clients stay on track and avoid future financial setbacks, which is a core focus at Better Debt Solutions.

Why Geographic Support Matters in Debt Management

Debt challenges can vary by location due to cost-of-living differences. Individuals seeking debt management solutions in Texas or debt management services in California often face unique financial pressures.

Local awareness helps ensure repayment plans remain practical and sustainable. A plan designed with geographic factors in mind can better support long-term financial stability.

Why Geographic Support Matters in Debt Management

Debt challenges can vary by location due to cost-of-living differences. Individuals seeking debt management solutions in Texas or debt management services in California often face unique financial pressures.

Local awareness helps ensure repayment plans remain practical and sustainable. A plan designed with geographic factors in mind can better support long-term financial stability.

Final Thoughts

The right debt management solutions can transform financial stress into a manageable, goal-driven process. By choosing a structured debt managemnet plan and working with trusted professionals like Better Debt Solutions, individuals can simplify repayment, reduce interest, and move steadily toward a debt-free future.

Frequently Asked Questions

What are debt management solutions?

Debt management solutions are structured programs designed to help individuals repay unsecured debts in an organized way. They simplify payments, reduce interest rates, and provide a clear path toward becoming debt-free.

How does a debt management plan help reduce debt?

A debt managemnet plan combines multiple debts into one monthly payment while creditors agree to lower interest rates or waive fees. This allows more of your payment to go toward reducing the actual balance.

Can I use a debt management plan calculator before enrolling?

Yes, a debt managemnet plan calculator helps estimate monthly payments and repayment timelines. It gives a realistic picture of affordability before committing to a plan.

How do I choose the best debt management companies?

The best debt management companies offer transparent pricing, customized plans, and ongoing support. They review your finances carefully and focus on long-term results rather than quick fixes.

Are debt management services available in states like Texas and California?

Yes, professional debt management services are available nationwide, including in Texas and California. State-specific support helps ensure plans remain practical based on local cost-of-living factors.