Home » Credit Counseling / Debt Management

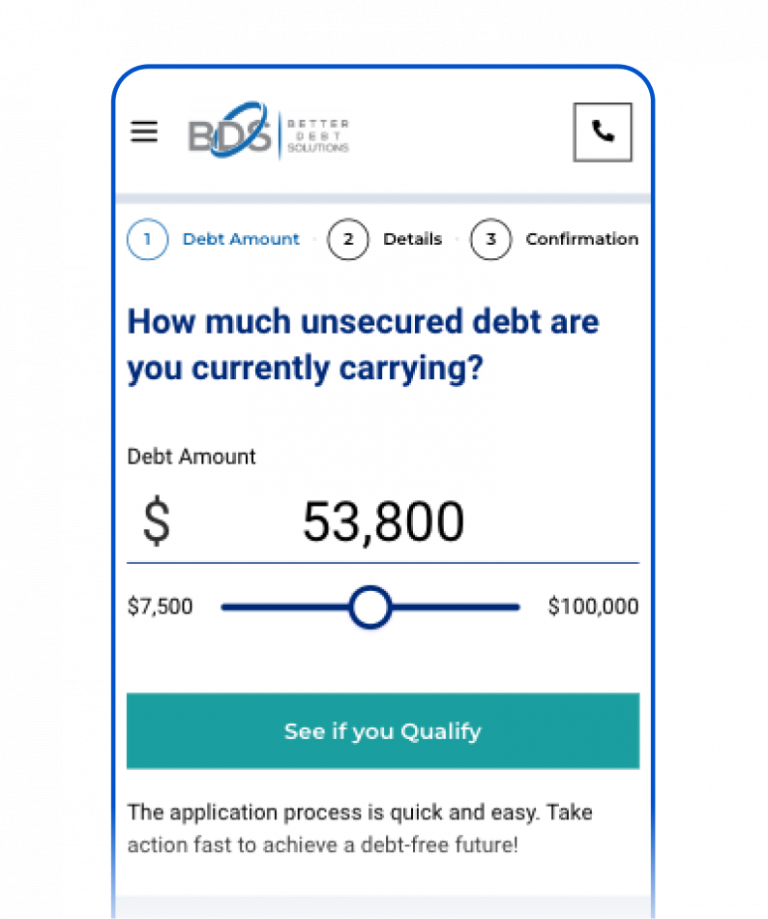

If you’re struggling with your finances, it’s important to know that several options are available to help you get back on track. However, determining which option suits your specific needs can be challenging. We invite you to speak with one of our representatives today and provide details about your financial situation so that we can explore the options available and guide you toward the most appropriate choice for you.

Talk to a certified debt consultant. +1 (866) 606-6413

There are multiple cons to debt management, which include:

It’s important to consider all the pros and cons of debt management before deciding if it’s the right option for you. It may be helpful to speak with a credit counselor and explore other debt relief options, such as debt consolidation or bankruptcy, to determine the best course of action for your situation.

Excellent

Fast, efficient and a pure delight to work with!!!! I had the absolute privilege of working with a young woman named Marissa Ciara who handled my account.

Thomas Clark

David Karmann is kind, caring and considerate! He is also patient and was truly a pleasure to speak with.

Ethan Martinez

Representative is always helpful and knowledgeable and makes me feel secure in the fact I am on my way to debt resolution. Happy customer! Highly recommended.

Renee Courtney

Ken helped a friend of mine get out of debt and I figured I would give this a shot due to her success.

James

Get your financial freedom back and have a new beginning.

Call us Now: (866) 606-6413

Office Hours

Monday – Friday: 7:00 AM – 7:00 PM PST

Saturday: 8:00 AM – 4:00 PM PST

Debt Management Services

Resources

Privacy

Copyright © 2025 Better Debt Solutions, LLC. All rights reserved.

This company does not actually provide any debt settlement, debt consolidation, or other credit counseling services. We ONLY refer you to companies that want to provide some or all of those services. On average, consumers who successfully complete a debt relief program see average savings of 40% to 60% of their enrolled debt load before program fees. Program fees are calculated based on a percentage of your enrolled debt and typically range from 14% to 27%. Programs are not available in all states, and fees may vary by state. Programs typically run from 24 to 48 months, depending on a consumer’s debt load and individual circumstances. Consumers must save at least 25% of the total amount of each enrolled debt before a debt relief company can make a bona fide settlement offer to a consumer’s creditors. Settlements typically occur every 3 to 6 months, with clients receiving their first settlement within 4 to 7 months of enrollment. Although we cannot guarantee specific results, we work closely with consumers to ensure they are connected with a debt relief provider that can achieve their best possible outcomes. We do not assume clients’ debts, make monthly payments to creditors, or provide tax, bankruptcy, accounting, legal advice, or credit repair services. Please contact a tax professional to discuss the tax consequences of debt relief and a bankruptcy attorney for more information on bankruptcy. Please note that using debt resolution services will likely have an adverse effect on your credit, and you may face collections or lawsuits from creditors or collectors. Additionally, your outstanding debt may increase due to the accrual of fees and interest. Before enrolling, it is essential to read and understand all of your program terms, conditions, and materials. Please note that certain types of debts may not be eligible for enrollment. Also, some creditors may not be eligible for enrollment because they do not negotiate with debt relief companies. Better Debt Solutions, LLC (2525 Main Street Suite 500, Irvine, CA 92614) is accredited by the Better Business Bureau. Contact us today to learn more about how we can help you achieve financial freedom.