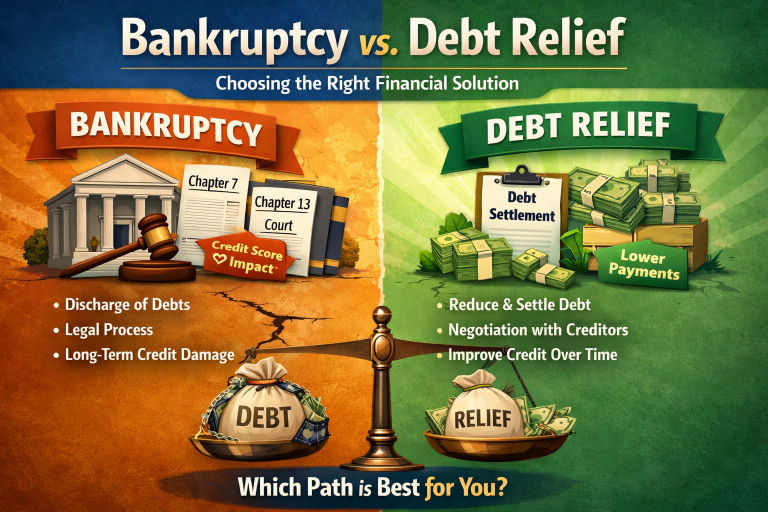

When debt becomes overwhelming, many people feel bankruptcy is the only option. However, bankruptcy is not always the best or only solution. Understanding the difference between bankruptcy vs. debt relief can help you make an informed decision that protects your financial future.

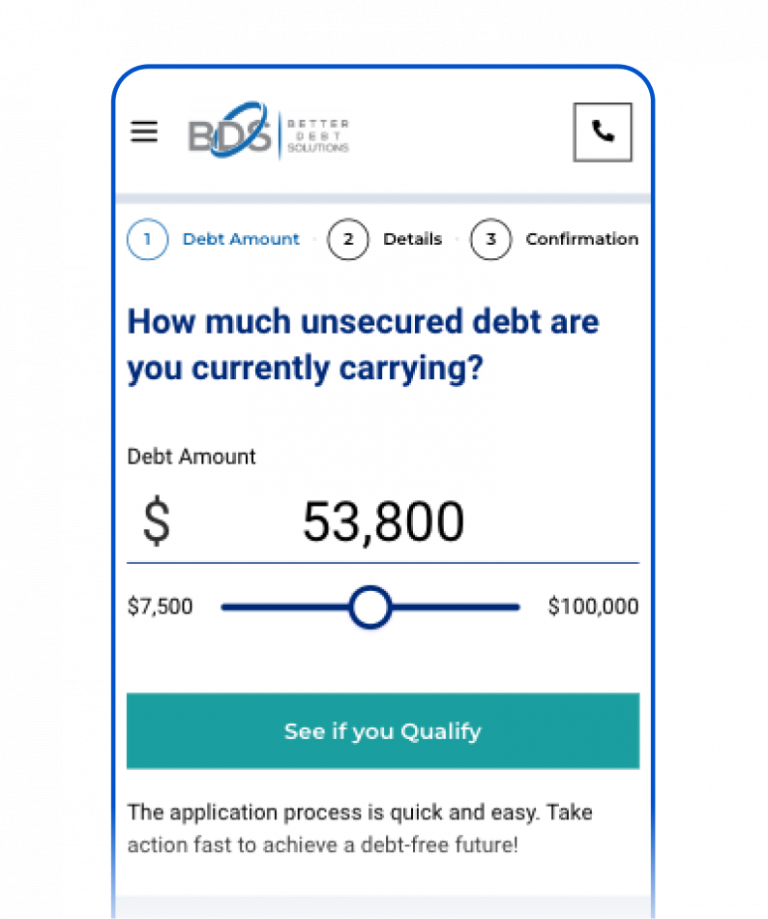

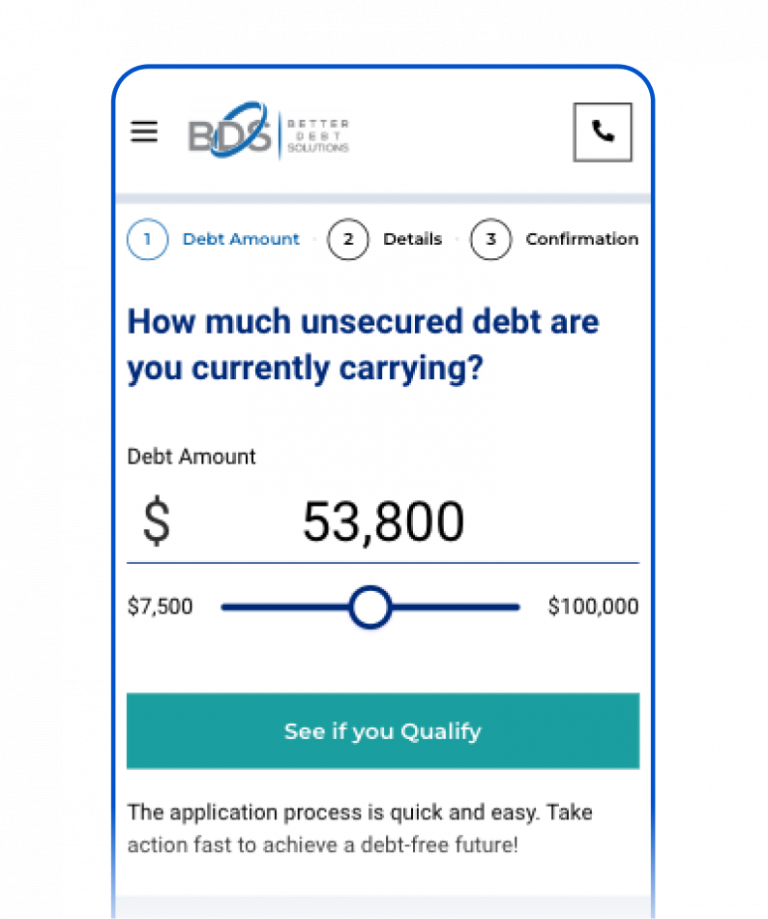

At Better Debt Solutions, we help individuals explore alternatives to bankruptcy through proven debt relief solutions, structured repayment programs, and expert guidance. Before filing for bankruptcy or considering a bankruptcy loan, it’s important to understand all your options and choose the path that offers long-term stability.

Talk to a certified debt consultant. +1 (866) 606-6413

Bankruptcy is a legal process designed to help individuals eliminate or restructure debt under court supervision. While it can provide relief, it often comes with serious long-term consequences, including:

Many people turn to bankruptcy when they feel trapped by debt, but in many cases, good debt relief programs can offer similar relief without the lasting impact on your credit and financial reputation.

A bankruptcy loan is often marketed as a way to rebuild credit after filing. However, these loans usually come with very high interest rates, strict repayment terms, and limited flexibility. While they may help in the short term, they often increase financial pressure instead of reducing it.

Before relying on a bankruptcy loan, it’s worth exploring debt relief options that reduce or restructure debt before bankruptcy becomes necessary.

Understanding bankruptcy vs. debt relief is key to choosing the right financial path.

Working with the best debt relief companies allows you to explore solutions that are less damaging and more flexible than bankruptcy. These programs may include:

At Better Debt Solutions, we focus on good debt relief programs that align with your income, debt level, and long-term goals helping you avoid unnecessary financial setbacks.

Better Debt Solutions provides expert support for individuals seeking alternatives to bankruptcy. Our process includes:

We review your income, expenses, and debt to determine the most effective solution.

We recommend tailored debt relief solutions based on your needs without court involvement.

Our team manages negotiations, monitors progress, and supports you until you regain financial stability.

Our mission is to help you resolve debt responsibly while protecting your future.

While debt relief works for many people, bankruptcy may still be appropriate in extreme cases, such as prolonged income loss or unmanageable secured debt. Even then, consulting with a debt relief expert first ensures you’ve explored all possible alternatives.

Before filing for bankruptcy or relying on a high-interest bankruptcy loan, explore your options with Better Debt Solutions. With the right guidance, many individuals discover they can resolve debt without court proceedings or long-term financial damage.

Start with a free consultation and learn whether debt relief is the right solution for you.

There are several different types of bankruptcy that an individual or business may file. Each type is designed to help debtors deal with their financial situation in the most beneficial way. Some of the most common types of bankruptcy include:

Also known as “straight bankruptcy,” this is the most common type of bankruptcy for individuals. It involves the liquidation of assets to pay off debts. The debtor’s non-exempt assets are sold, and the proceeds are distributed to creditors. The remaining debts are discharged, and the debtor is released from personal liability for those debts.

The costs of different types of bankruptcy can vary depending on the complexity of the case, the type of bankruptcy, and the location. Here are some general cost ranges for the three main types of bankruptcy in the United States:

Bankruptcy can have several negative consequences, including:

It’s important to carefully consider the potential consequences before deciding to file for bankruptcy. Bankruptcy should be considered as a last resort when other options for managing debt have been exhausted.

The frequency with which you can file for bankruptcy and the duration of its impact on your credit report depend on the type of bankruptcy you file:

It’s important to note that even though bankruptcy will remain on your credit report for a certain period of time, the negative impact on your credit score may lessen over time, especially if you take steps to rebuild your credit. Additionally, some lenders and creditors may be willing to extend credit to those who have filed for bankruptcy if they can demonstrate responsible financial behavior over time.

To discover whether bankruptcy is right for you, or how to avoid it, contact Better Debt Solutions today to learn about all of your options.

The cost of a Chapter 13 bankruptcy is usually less than a Chapter 11 bankruptcy, but it can still be costly. Attorney fees for a Chapter 13 bankruptcy can range from $2,000 to $5,000, and there are court filing fees and credit counseling fees as well.

Excellent

Fast, efficient and a pure delight to work with!!!! I had the absolute privilege of working with a young woman named Marissa Ciara who handled my account.

Thomas Clark

David Karmann is kind, caring and considerate! He is also patient and was truly a pleasure to speak with.

Ethan Martinez

Representative is always helpful and knowledgeable and makes me feel secure in the fact I am on my way to debt resolution. Happy customer! Highly recommended.

Renee Courtney

Ken helped a friend of mine get out of debt and I figured I would give this a shot due to her success.

James

Get your financial freedom back and have a new beginning.

Call us Now: (866) 606-6413

Bankruptcy is a legal process that can eliminate debt but causes long-term credit damage. Debt relief focuses on reducing or restructuring debt without court involvement, offering a more flexible and less damaging alternative.

For many people, yes. Debt relief solutions help manage or reduce debt while preserving credit health and avoiding legal consequences associated with bankruptcy.

A bankruptcy loan is typically offered after filing bankruptcy to rebuild credit, but it often comes with high interest rates and strict repayment terms, making it a risky option.

The best debt relief companies offer transparency, customized programs, clear communication, and proven results. Better Debt Solutions focuses on ethical practices and personalized support.

In many cases, yes. With the right program and timely action, debt relief can reduce financial pressure and eliminate the need for bankruptcy.

Office Hours

Monday – Friday: 7:00 AM – 7:00 PM PST

Saturday: 8:00 AM – 4:00 PM PST

Location

2525 Main St #500, Irvine, CA 92614, United States

support@betterdebtsolutions.com

Debt Management Services

Resources

Privacy

Location

2525 Main St #500, Irvine, CA 92614, United States

support@betterdebtsolutions.com

Copyright © 2025 Better Debt Solutions, LLC. All rights reserved.

This company does not actually provide any debt settlement, debt consolidation, or other credit counseling services. We ONLY refer you to companies that want to provide some or all of those services. On average, consumers who successfully complete a debt relief program see average savings of 40% to 60% of their enrolled debt load before program fees. Program fees are calculated based on a percentage of your enrolled debt and typically range from 14% to 27%. Programs are not available in all states, and fees may vary by state. Programs typically run from 24 to 48 months, depending on a consumer’s debt load and individual circumstances. Consumers must save at least 25% of the total amount of each enrolled debt before a debt relief company can make a bona fide settlement offer to a consumer’s creditors. Settlements typically occur every 3 to 6 months, with clients receiving their first settlement within 4 to 7 months of enrollment. Although we cannot guarantee specific results, we work closely with consumers to ensure they are connected with a debt relief provider that can achieve their best possible outcomes. We do not assume clients’ debts, make monthly payments to creditors, or provide tax, bankruptcy, accounting, legal advice, or credit repair services. Please contact a tax professional to discuss the tax consequences of debt relief and a bankruptcy attorney for more information on bankruptcy. Please note that using debt resolution services will likely have an adverse effect on your credit, and you may face collections or lawsuits from creditors or collectors. Additionally, your outstanding debt may increase due to the accrual of fees and interest. Before enrolling, it is essential to read and understand all of your program terms, conditions, and materials. Please note that certain types of debts may not be eligible for enrollment. Also, some creditors may not be eligible for enrollment because they do not negotiate with debt relief companies. Better Debt Solutions, LLC (2525 Main Street Suite 500, Irvine, CA 92614) is accredited by the Better Business Bureau. Contact us today to learn more about how we can help you achieve financial freedom.