When debt becomes difficult to manage, many consumers compare debt consolidation vs. bankruptcy as potential solutions. While both aim to reduce financial stress, they work very differently and choosing the wrong option can have lasting consequences.

This guide explains how each option works and how Better Debt Solutions helps individuals choose smarter alternatives through structured debt relief solutions.

What Is Debt Consolidation?

Debt consolidation combines multiple debts into one loan with a single monthly payment. It works best for individuals who:

- Have a stable income

- Maintain fair to good credit

- Want to simplify payments

However, consolidation does not reduce debt,it only restructures it.

What Happens When You Choose Bankruptcy?

Bankruptcy can discharge or restructure debt through court proceedings, but it also:

- Damages credit for up to 10 years

- Limits borrowing opportunities

- Creates a public financial record

Many people then rely on bankruptcy loans, which often come with high interest and strict repayment terms.

Debt Consolidation vs. Bankruptcy – Key Differences

Debt Consolidation

- One new loan

- Requires credit approval

- No debt reduction

- Faster credit recovery

Bankruptcy

- Legal process

- Credit damage for years

- Asset risk in some cases

For many consumers, consolidation is safer than bankruptcy but it still isn’t always the best option.

Why Debt Relief Programs Are Growing in 2025

With high interest rates and tighter lending, many people no longer qualify for consolidation loans. This has led to increased demand for good debt relief programs, including:

- Debt settlement

- Interest reduction plans

- Personalized repayment solutions

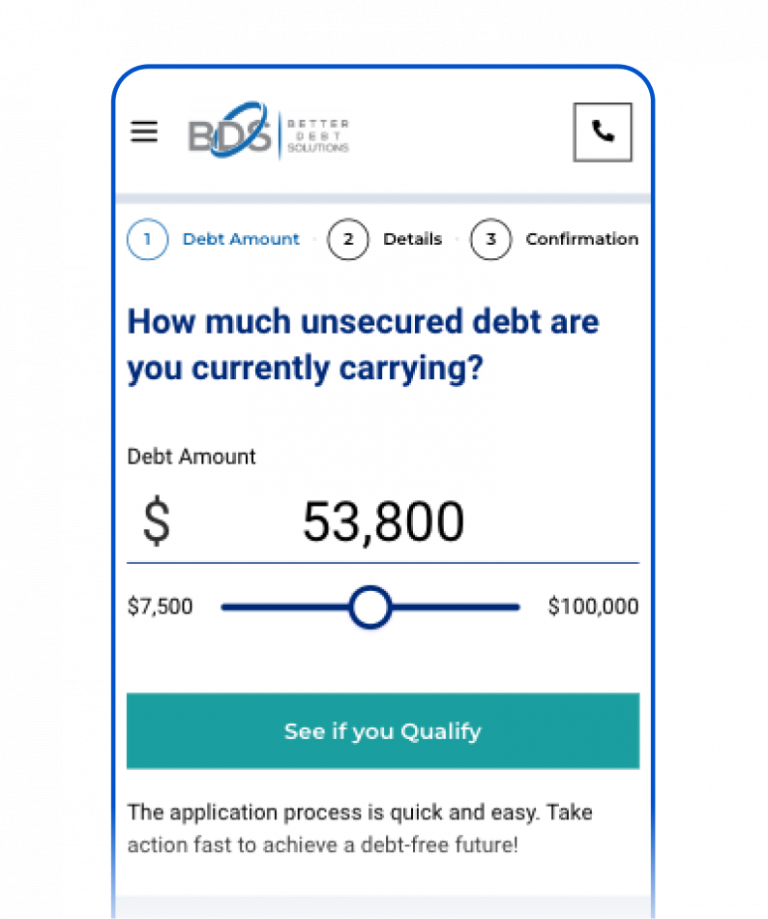

How Better Debt Solutions Guides the Right Choice

Better Debt Solutions evaluates:

- Income stability

- Total debt

- Credit profile

- Financial hardship

Based on this, we recommend consolidation, relief programs, or—only when necessary bankruptcy alternatives.

Choose Financial Recovery, Not Financial Setback

Before choosing bankruptcy or taking a risky bankruptcy loan, explore structured debt relief options that offer flexibility and long-term recovery.

A free consultation with Better Debt Solutions can help you choose the right path.

Frequently Asked Questions

Is debt consolidation better than bankruptcy?

Yes, for many people, because it avoids court involvement and long-term credit damage. Debt consolidation allows borrowers to combine multiple debts into a single monthly payment, making repayment easier to manage. Unlike bankruptcy, it does not create a public legal record and may help preserve credit standing when payments are made consistently over time.

Can consolidation reduce my debt amount?

No. Consolidation simplifies payments but does not reduce principal. The total amount owed remains the same, even though the structure of repayment changes. While consolidation may lower interest rates in some cases, it focuses on convenience rather than reducing overall debt balances.

What if I don’t qualify for a consolidation loan?

Debt relief programs may offer a better alternative without new loans. These programs focus on negotiating with creditors instead of extending additional credit. This option can be helpful for individuals with lower credit scores or high debt-to-income ratios who may not qualify for traditional consolidation loans.

Are bankruptcy loans safe?

They often carry high interest and should be approached cautiously. Bankruptcy loans are typically offered to borrowers with damaged credit, which increases borrowing costs. While they may provide temporary relief, the long-term expense can outweigh the short-term benefit if not carefully evaluated.

How do I choose the right option?

A professional assessment from Better Debt Solutions helps you choose wisely. A detailed review of your financial situation, debt type, and repayment ability ensures the most suitable path forward. Exploring options early can help avoid unnecessary credit damage and long-term financial stress.