What Is Credit Counseling?

Credit counseling is a professional service that helps individuals manage debt and improve their credit score. It offers guidance, tools, and personalized plans to help you understand your finances and reduce debt over time.

Most credit counseling services are offered by nonprofit agencies. Their goal is to educate people about budgeting, credit management, and financial planning. They also help create debt management plans (DMPs) to simplify monthly payments and lower interest rates.

How Does Credit Counseling Work?

Here’s how a typical credit counseling process works:

- A certified credit counselor reviews your financial situation.

- You receive advice on budgeting and managing your money.

- If needed, they may offer a Debt Management Plan (DMP).

- The DMP consolidates your unsecured debts into a single payment.

- You may receive lower interest rates and waive late fees.

While many services are free, some agencies charge a small monthly fee. Always ask for a full cost breakdown before signing up.

How to Choose the Right Credit Counseling Service

Not all services are created equal. Here are 3 key things to consider:

1. Accreditation and Credentials

Choose an agency affiliated with trusted organizations like the National Foundation for Credit Counseling (NFCC). This ensures they follow ethical and professional standards.

2. Transparent Fees

A trustworthy agency will clearly explain all fees. Avoid those that won’t discuss pricing upfront or pressure you into unnecessary services.

3. Positive Reviews

Look for agencies with good client testimonials on their website or trusted review platforms. Avoid agencies with too many negative reviews or vague credentials.

With so many options available, choosing the right credit counseling service provider is super important. Here are some important things to think about:

Red Flags and Credit Counseling Scams

Be cautious of services that:

- Promise to boost your credit score instantly – Real improvement takes time.

- Hide fees or use high-pressure tactics – A good agency is transparent.

- Lack of industry certifications – No NFCC or BBB affiliation is a red flag.

If it sounds too good to be true, it probably is.

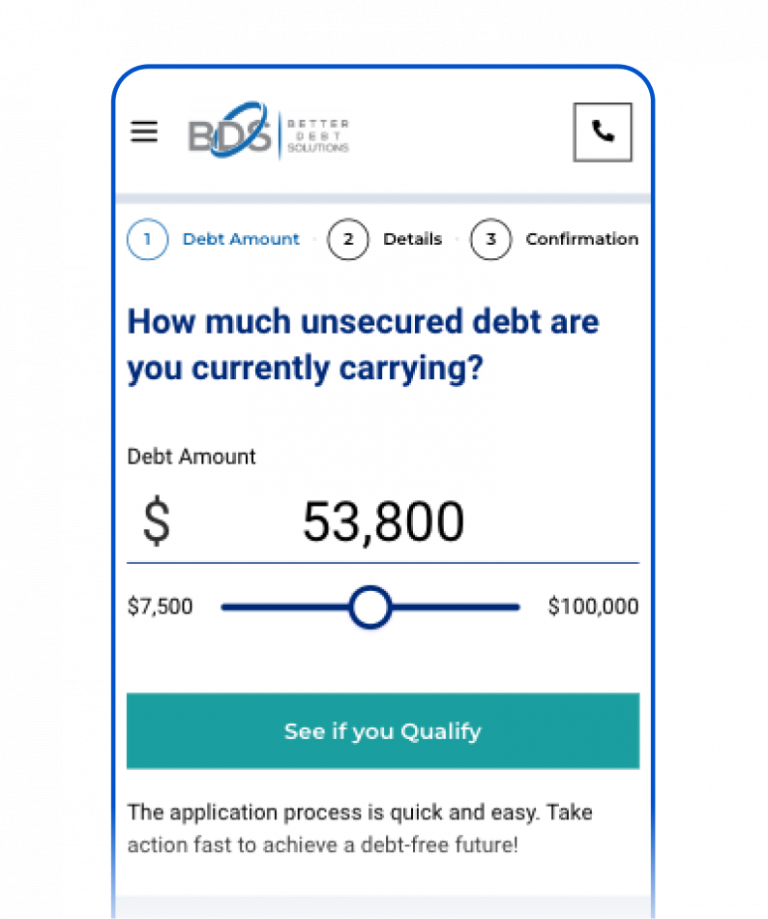

How Better Debt Solutions Can Help

At Better Debt Solutions, we make debt relief easy to understand. Our team offers:

- Free debt analysis tailored to your needs

- Customized debt management and credit counseling

- Transparent fee structure with no hidden charges

- Expert advice from trained professionals

Whether you’re overwhelmed by credit card debt or just need help managing payments, we’re here to guide you every step of the way.

Contact us today to start your path toward financial freedom.

Alternatives to Credit Counseling

If credit counseling isn’t the right fit, consider these options:

- Debt Settlement – Negotiate to pay a reduced amount.

- Bankruptcy Counseling – Understand your legal rights before filing.

- Self-managed budgeting – Use budgeting apps and free financial tools.

- Debt Consolidation Loans – Combine your debts into one loan.

While some options may impact your credit score, counseling services help you weigh all your choices wisely.

Conclusion

Credit counseling is more than debt relief; it’s a tool for long-term financial wellness. With the right guidance, you can:

- Improve your credit score

- Pay off debt efficiently

- Gain control over your finances

Don’t let debt hold you back. Get the support you need and take the first step toward a stable financial future with Better Debt Solutions.