Many struggle with numerous debts, from credit cards, personal loan funds, or student loans. This multifaceted debt challenge can be manageable and also costly in terms of high interest rates. Fortunately, there’s a potential solution in sight: debt consolidation loans.

This guide delves deep into this financial tool, offering insights, benefits, and real-life testimonies of its effectiveness.

What is a Debt Consolidation Loan?

Debt consolidation is a strategic financial solution to bundle multiple smaller debts into one streamlined loan. Its primary goal? To simplify the debt landscape for borrowers. Instead of grappling with numerous payments, each with varying rates and deadlines, borrowers have the convenience of a single monthly payment, often at a more favorable interest rate.

There are two primary avatars of debt consolidation: secured and unsecured. Like a home equity loan, the former is backed by an asset, often a property. On the flip side, unsecured loans don’t hinge on collateral, but they might tote a marginally higher interest rate, given the augmented risk the lender assumes.

Debt consolidation is a financial product designed to merge multiple debts into one. Instead of juggling several payments every month, you only manage one, often with a reduced interest rate. It’s crucial to note that this doesn’t eliminate your debt; it restructures it, possibly making it more manageable.

While similar to personal loans or balance transfers, debt consolidation is distinct as they are explicitly designed to consolidate numerous debts. They may come with specific terms and conditions tailored for people in debt-heavy situations.

Benefits of Debt Consolidation Loan

Debt consolidation has risen in popularity as a go-to solution for those overwhelmed by a ton of debt. By bundling various financial obligations into one comprehensive loan, they offer numerous advantages to borrowers. But what exactly are these benefits?

Simplified Payments

Potential Savings on Interest

Often, credit card debt comes with exorbitant rates. By consolidating, you might lock in a lower rate with the consolidation loan. Over time, these reduced rates can translate to significant savings, especially considering how much you pay interest over the life of pending debts.

Improved Credit Score

Managing multiple debts can occasionally lead to missed payments, denting your credit score. By consolidating, you ensure timely payments. In the long run, it can boost your credit score. Remember, maintaining a healthy credit history is crucial for future financial endeavors.

Flexibility in Loan Choices

There are a lot of flexible choices to help in being debt-free. Whether you opt for an unsecured personal loan, a home equity loan, or even explore peer-to-peer lender options, various avenues are available for debt consolidation. Some even offer the best debt consolidation loans tailored for those with bad credit.

Transparent Fees

While some loans might come with origination fees, these are usually upfront. This transparency means fewer surprises compared to the often-hidden fees of credit cards.

How to Determine if a Debt Consolidation Loan is Right for You

Assess Your Debt Landscape

Calculate Potential Savings

Utilize a debt consolidation calculator to determine how much you might save money over the new loan term compared to your current debts.

Research Loan Options

There are numerous avenues to consolidate debt. Whether it’s a personal loan, home equity loan, or home equity line, it’s crucial to understand the terms. Look into individual loan interest rates, loan amounts, and if there are any origination fees.

Consider Your Credit History

Lenders don’t just look at your score; they also assess your credit history. Multiple late payments or a history of debt settlement may be red flags.

Seek Professional Advice

Understand the Implications

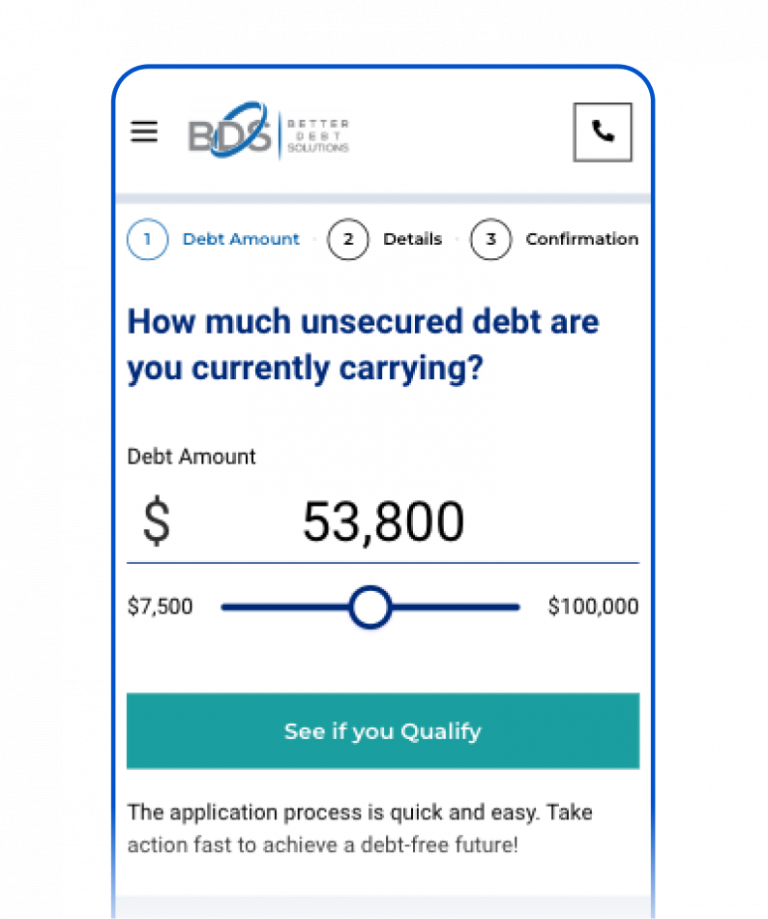

Better Debt Solutions

Success Stories: Real-life Debt Consolidation Wins

Discover the transformative experiences of individuals who entrusted their financial struggles to Better Debt Solution. Through numerous testimonials and a whopping 747 reviews, Better Debt Solution has consistently achieved a 5-star rating. Dive into these success stories to see how this esteemed organization has made a significant impact on real lives, guiding individuals toward financial stability and peace of mind. The consistently high ratings are a testament to Better Debt Solution’s dedication, expertise, and the tangible results they deliver to their clients.

Wilma Holder’s Journey to Streamlined Finances

Wilma Holder felt alone and had no idea how to get out of debt. It was an awful feeling for her. That’s when she decided to try a consolidation company to help. When asked how she found a way to help with her debt issues, she said. “I found some really good reviews online about Better Debt Solutions, so I decided to reach out.”

“I was met with such kindness and understanding g of my current situation along with a ton of knowledge, it seemed like the right move. I’m new in the process but I have complete confidence in BDS,” she added.

How Lisa Lowered Her Interest Rates

Lisa, a talented freelance designer, was caught in a relentless cycle of revolving credit card debt. Each month, she juggled numerous debts and found herself paying more towards interest than the principal. With every due date, not only did her financial strain deepen, but the consistent reporting to credit bureaus also posed a potential threat to her credit score.

Seeking ways to consolidate debt, Lisa did her homework. She researched the pros and cons of home equity loans, considered personal loan options, and even reached out to financial institutions that offer debt consolidation. In her exploration, Lisa realized that consolidating her numerous debts could be the best way to streamline her monthly payments and free up some of her income, which was currently directed toward high interest rates. After extensive research, she opted for a personal loan tailored to consolidate her debts.