If you want to improve your financial future, it’s important to know how to manage your credit score well. For a lot of people, managing credit can be confusing and stressful. Good thing, you don’t have to go through it alone because of credit counseling.

This article breaks down what is credit counseling and how it works. It also discusses how to select the right credit counseling service and potential red flags and scams. Lastly, it shows how Better Debt Solution can help and other alternatives.

What is Credit Counseling?

Credit counseling is a helpful service that guides people through money troubles, especially issues with debt. The main goal is to provide advice, useful tools, and information to help folks understand money better and get a handle on their debts.

Often provided by nonprofit credit counseling agencies, credit counseling aims to educate consumers about managing their consumer credit and help them make informed decisions about tackling debt. While there are for-profit entities in the field, non profits often provide more unbiased and affordable assistance.

How Does Credit Counseling Work?

One of the primary services provided by credit counseling agencies is the formulation of a repayment plan. This plan consolidates multiple debts into a single payment, often with reduced interest rates and waived late fees. It can be an effective strategy for those struggling to manage multiple debts.

Beyond debt management, credit counselors often offer a wide range of educational resources to improve individuals’ understanding of their financial lives. This can range from basic budgeting techniques to strategies to avoid falling into debt.

Once engaged with a credit counseling agency, clients often collaborate with credit counselors. These certified professionals review your financial situation, provide money management advice, and can even help draft a debt management plan (DMP). A DMP is designed to provide relief by consolidating your debts into a single monthly payment, possibly with lower interest rates.

While many services are provided at low or no cost, some agencies might charge monthly fees for specific services. It’s crucial to inquire about all potential costs upfront and understand what you’re agreeing to pay.

Selecting the Right Credit Counseling Service

Finding your way through debt and money problems can be tough, and a good credit counseling service can really help. But not all agencies are made equal. It’s essential to ensure you’re working with a reputable credit counseling organization. Authenticity can often be validated through the better business bureau or by checking for affiliations with the national foundation. Always prioritize agencies that provide free educational materials and ensure transparency in their services.

With so many options available, choosing the right credit counseling service provider is super important. Here are some important things to think about:

Accreditation from Recognized Bodies

When seeking the right credit counseling service, it’s essential to prioritize agencies with accreditation from reputable organizations, such as the National Foundation for Credit Counseling (NFCC). Transparency in fee structures, as showcased by Better Debt Solutions, is crucial to avoid hidden costs and ensure value for services rendered. Potential clients should also consider agencies with positive testimonials, reflecting quality service and successful outcomes. With entities like Better Debt Solutions in the market, choosing the right agency becomes pivotal for a well-guided financial journey, aimed at achieving one’s financial goals.

Transparent Fee Structures

Finances are fundamental in credit counseling, making a transparent fee structure vital to ensure clients understand what they’re paying for, without surprises. When considering a service, it’s essential to verify that the agency offers a clear cost breakdown, aligning with the services they provide, whether they are free or come with a nominal charge. However, caution is advised against agencies that dodge discussing fees initially, have intricate fee systems, or push services that may not be necessary, leading to avoidable expenses.

Positive Client Testimonials and Reviews

Previous clients’ testimonials are crucial in gauging the quality, professionalism, and outcomes of a credit counseling agency. Reputable agencies often showcase positive feedback on their websites, and third-party platforms or local business bureaus offer impartial reviews. Positive remarks about debt management successes and enhanced financial understanding are promising indicators. However, agencies with numerous negative reviews or those lacking a significant review history should be approached with caution, as they might require more thorough vetting.

Potential Red Flags and Scams

While many organizations offer genuine help, some may not have your best interests at heart. Recognizing potential pitfalls can save you both money and heartache. These are some things to look out for:

Services Promising Overnight Credit Score Transformations

True credit repair is a lengthy process demanding time, patience, and consistent effort. Services offering instant results or dramatic improvements are often misleading and might employ dubious tactics, potentially causing even greater financial troubles in the future. They could also simply be schemes to extract money without delivering tangible results. As a consumer, it’s vital to approach such claims with caution, understanding that genuine credit score enhancement is a gradual process, not an instantaneous one.

Hidden Fees or Aggressive Sales Tactics

Legitimate credit counseling services prioritize transparency in their fee structures. It’s a red flag when a company is elusive about its fees or employs forceful sales techniques to secure your commitment. Such hidden costs can escalate, potentially leading to larger financial outlays than anticipated. Moreover, aggressive sales strategies can push clients into decisions that may not benefit them. Before committing to any service, it’s essential to grasp all associated fees, and if faced with undue pressure, it’s advisable to pause and re-evaluate.

Lack of Clear Credentials or Affiliations

Reputable credit counseling agencies often possess affiliations with established industry organizations or relevant certifications, underscoring their credibility. An absence of clear credentials can indicate that an agency may not adhere to industry best practices or might be ill-equipped to offer appropriate guidance, raising concerns about their legitimacy or even potential fraudulent intentions. Before engaging with any agency, it’s crucial to verify their affiliations or credentials. Accrediting bodies, like the National Foundation for Credit Counseling (NFCC), can vouch for the authenticity and standards of genuine agencies.

How Better Debt Solutions Can Help?

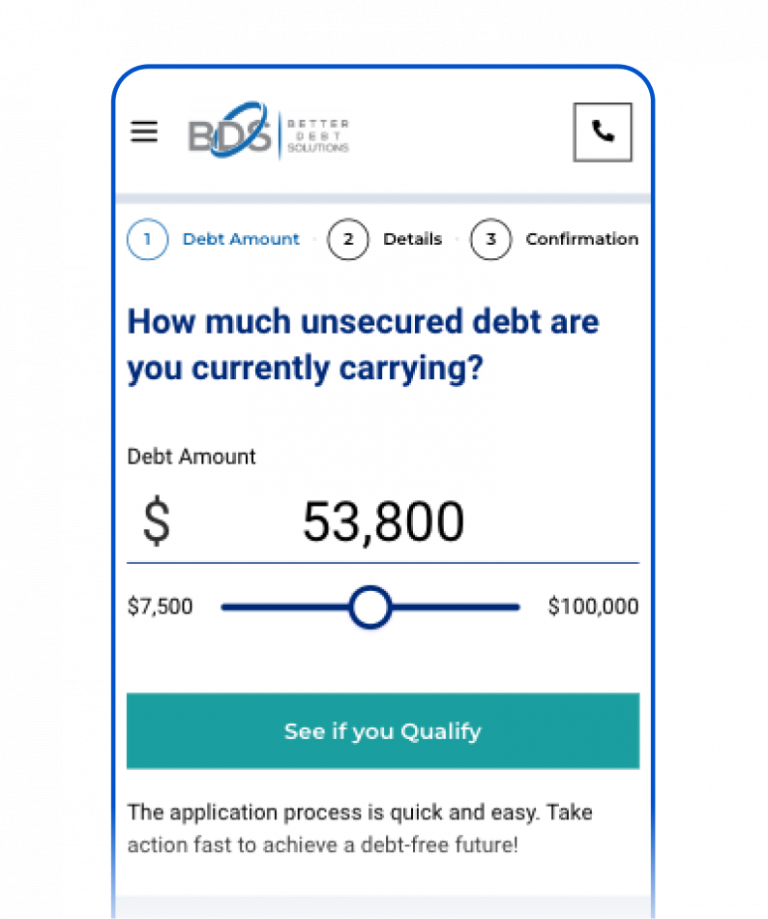

At Better Debt Solutions, we understand that managing your finances can be overwhelming, especially if you’re grappling with debt. That’s why we offer a range of services, including credit counseling and debt management, to help you find the best way to get back on your feet financially. Our dedicated representatives are available for free debt analysis, aimed at understanding your unique financial situation. Once we have a clear picture, we can walk you through the different options that are available to you, helping you make an informed choice tailored to your needs. Contact us today to take the first step toward better financial management.

The Role of Credit Counseling and Alternative Solutions

What happens when one finds themselves in credit card debt, struggling with monthly payments, and seeing the shadow of debt collectors looming? The answer may lie in seeking the right help, and understanding the role of credit counseling.

While a debt management plan can be a beacon of hope for many, it’s crucial to understand its nuances. There might be a monthly fee associated, or a set up fee. It’s also vital to recognize that while DMPs consolidate payments, they don’t erase debt. They merely restructure it to make it more manageable.

Some individuals might consider debt settlement companies as an alternative, hoping for a lump sum resolution. However, it’s essential to approach such avenues with caution. Often, these for-profit companies can have negative effects on your credit report.

In contrast, a credit counseling service not only assists in managing current debt but equips clients with tools and knowledge for a stable financial life. Whether it’s budget counseling, housing counseling, or guidance on the bankruptcy process, these organizations aim to empower individuals to make informed decisions.

To conclude, while credit is a powerful tool, it demands responsibility. If ever in a bind, remember, credit counseling organizations exist to guide and support. Don’t let the weight of debt hold you back. Seek the right help, set your sights on healthier financial horizons, and remember the importance of a good credit score in your financial journey.