Over the past decade, bankruptcy filings have witnessed a surge, painting a sobering picture of the financial distress many face. Navigating the murky waters of bankruptcy can be daunting, but a comprehensive understanding of its implications can make the journey smoother. This guide will unpack bankruptcy, its impact, and potential alternatives to consider.

According to an article published by United States Court, filing bankruptcy rose up to 10 percent

as of June 2023. Compared to the previous year,

What is Bankruptcy?

Bankruptcy, as defined by the bankruptcy code, is a federal court process designed to provide both individuals and businesses an opportunity for debt relief while being afforded protection and a fresh start. Those overwhelmed with debt can turn to bankruptcy laws to help them regain a stable financial footing. When someone decides to file bankruptcy, they initiate a legal process by submitting a bankruptcy petition to the bankruptcy court. This is a significant decision that can impact one’s credit report for years.

There are different forms of bankruptcy. For instance, Chapter 7 bankruptcy involves the liquidation of the debtor’s assets by a bankruptcy trustee to pay creditors. This is one of the most common types of bankruptcy filings. It can discharge a vast majority of unsecured debts like credit card debt, medical bills, and personal loans, allowing the debtor to start anew. However, certain debts like student loan debt, child support, and unpaid taxes often can’t be discharged in bankruptcy proceedings.

On the other hand, family farmers or individuals with a regular income can opt for other chapters which allow them to draft a repayment plan. This repayment plan helps them repay outstanding debts over time. Chapter 13, for example, lets individuals file bankruptcy by consolidating their debts and proposing a 3-5 year repayment plan. The repayment of some debts is prioritized over others.

It’s important to note that bankruptcy law requires individuals filing bankruptcy to undergo credit counseling. A bankruptcy lawyer can guide one through the bankruptcy process, ensuring they’re well-informed and making the right decisions. They can help with the preparation of bankruptcy forms, necessary documentation, and offer advice on other debt relief options.

It’s also crucial to recognize the signs of potential scams or misinformation. The American Bankruptcy Institute, along with free legal services, can provide resources for understanding bankruptcy basics.

In conclusion, while bankruptcy provides a legal means to address financial distress, it’s not a one-size-fits-all solution. It requires thorough consideration, understanding of federal bankruptcy laws, and often, guidance from professionals.

Bankruptcy, at its core, is a legal process that individuals or businesses undertake when they cannot repay their debts. Broadly, the two most common types are:

Chapter 7 Bankruptcy

Chapter 7 Bankruptcy, often referred to as “liquidation” or “straight” bankruptcy, is a provision under the U.S. federal bankruptcy laws designed to provide relief to individuals and businesses overwhelmed by debt. When an individual or entity files for Chapter 7, a bankruptcy trustee is appointed to oversee the case. The trustee’s primary role is to sell or “liquidate” the debtor’s non-exempt assets, using the proceeds to pay off creditors.

While Chapter 7 allows debtors to eliminate a significant portion of their debts, not all debts can be discharged. Common unsecured debts like credit card balances and medical bills are typically wiped out, but certain debts, such as most student loans, child support, and unpaid taxes, remain.

To qualify for Chapter 7, individuals must pass the “means test,” which assesses their financial capacity. If their income is too high, they might be directed towards filing a Chapter 13 bankruptcy instead. Importantly, filing for Chapter 7 can significantly impact one’s credit report, remaining for up to ten years. Nonetheless, for many facing insurmountable debt, Chapter 7 offers a chance to start afresh financially. It’s crucial, however, to consult with a bankruptcy lawyer before making such a pivotal decision.

Chapter 13 Bankruptcy

Chapter 13 Bankruptcy, governed by federal bankruptcy laws, is a legal process designed primarily for individual debtors facing financial distress but with a consistent income to develop a plan to repay all or part of their debts. Contrary to Chapter 7, which liquidates assets to pay creditors, Chapter 13 allows debtors to retain their properties and instead sets up a repayment plan to clear debts over three to five years.

When a debtor files a Chapter 13 bankruptcy case, they propose a repayment plan based on their average monthly income, addressing both secured debt like car loans and unsecured debt such as medical bills. This plan, upon court approval, binds the debtor and their creditors. During this repayment period, creditors cannot pursue unpaid debts outside of the bankruptcy process.

Some benefits of Chapter 13 include the opportunity to catch up on unpaid taxes and prevent interest accumulation on federal tax debts. Moreover, while federal student loans aren’t typically discharged, debtors can sometimes include them in their repayment plans. Personal bankruptcy, like Chapter 13, can be a viable alternative for those who don’t qualify for Chapter 7, offering them an avenue to financial planning and restructuring.

Importantly, navigating the complexities of federal courts and bankruptcy schedules requires understanding and expertise. Thus, seeking free legal services or consulting with a professional is crucial to ensure one’s interests are protected and that the process abides by federal law.

Common Reasons for Filing

The road to bankruptcy varies for many. Factors such as medical emergencies, job losses, or failed businesses often culminate in such filings. In 2019, medical expenses accounted for 66.5% of personal bankruptcies, underscoring the unforeseen challenges many face.

Bankruptcy is a complex legal proceeding undertaken by individuals, corporations, or municipalities when they cannot meet their financial obligations. While bankruptcy cases are filed in district courts, the reasons leading individuals or entities to declare bankruptcy are varied. Here are some common reasons, explained:

Medical Debt

One of the top causes for personal bankruptcy is insurmountable medical debt, often arising from unforeseen health issues or accidents leading to personal injury. Even with insurance, out-of-pocket expenses can be overwhelming.

Student Debt

With the rising cost of education, student debt has become a significant burden for many, especially when job opportunities are not lucrative enough to make the monthly payment on these loans.

Job Loss

Losing a primary source of income without adequate savings can quickly lead individuals to a situation where they can’t repay debts.

Excessive Debt

Sometimes, people accumulate more debt than they can handle, be it through credit cards, a car loan, or other financial commitments.

Corporate Bankruptcy

Businesses, large or small, may face bankruptcy due to declining sales, poor business decisions, or external factors affecting their industry.

Natural Disasters

Events like hurricanes, floods, or fires can lead to immense losses for which individuals or businesses might not have been adequately insured, forcing them to seek a bankruptcy discharge of their remaining debts.

It’s essential to understand that bankruptcy isn’t a decision made lightly. Often, individuals see it as their last resort after exhausting other options. The process involves various stages, including asset evaluation, where only exempt property might be retained, and the rest becomes part of the debtor’s estate, overseen by a trustee for liquidation or restructuring purposes.

Implications of Bankruptcy

Bankruptcy, often considered a last resort for individuals and entities facing overwhelming debt, carries various implications. While the concept might seem straightforward, when bankruptcy is explained in depth, its repercussions on one’s financial and personal life become more evident.

Firstly, with the introduction of bankruptcy reform over the years, the process has become more stringent. These reforms are designed to ensure that those who can repay their debts do so, while providing relief to those genuinely unable to meet their financial obligations. As a result, not everyone can easily access bankruptcy as a way out, and some might be required to undergo mandatory credit counseling or meet specific criteria before filing.

Secondly, a bankruptcy filing is not a discreet affair. It becomes a matter of public record in a district court, which means the details of one’s financial distress are available for public scrutiny. This can have repercussions on one’s reputation and might affect future financial and business endeavors.

Furthermore, for corporations operating in multiple countries, bankruptcy can get complicated. Other cross border cases may need to be considered, where laws and regulations of multiple jurisdictions come into play. This can make the bankruptcy process more prolonged and complex.

In conclusion, while bankruptcy offers a legal means to address unmanageable debts, its implications are far-reaching. It’s a decision that should be taken after careful consideration and consultation with legal and financial experts.

Benefits of Bankruptcy

Bankruptcy is often viewed negatively due to the implications it can have on one’s credit and reputation. However, when facing insurmountable financial difficulties, bankruptcy can offer several benefits:

Debt Discharge

The primary benefit of bankruptcy is the discharge of debts. This means that, once the bankruptcy process is complete, the debtor is no longer legally required to pay any debts that are discharged.

Financial Fresh Start

Bankruptcy can provide individuals with a clean slate, allowing them to rebuild their financial life without the burden of past debts.

Property Protection

Bankruptcy laws allow individuals to keep certain exempt property. While these exemptions vary by jurisdiction, they typically include essentials like a primary residence, car, and personal belongings.

Stress Relief

Being in debt can be incredibly stressful. By filing for bankruptcy, individuals can alleviate the emotional and mental strain of dealing with creditors and mounting bills.

Restructuring of Debts

In some forms of bankruptcy, especially Chapter 13, individuals can restructure their debts, which can make repayment terms more favorable and manageable.

Avoiding Adverse Actions

Bankruptcy can halt adverse actions like foreclosure on a home or the repossession of a vehicle. Even if these actions can’t be permanently stopped, bankruptcy can provide time to negotiate or find alternative solutions.

Credit Rehabilitation

While bankruptcy does impact one’s credit negatively at first, it can also be the first step toward rebuilding credit. Over time, with disciplined financial practices, one can restore their credit score.

Legal Protection

Once the bankruptcy is filed, creditors are required to deal with the bankruptcy court and the appointed trustee, not the debtor directly. This provides a layer of legal protection for the debtor.

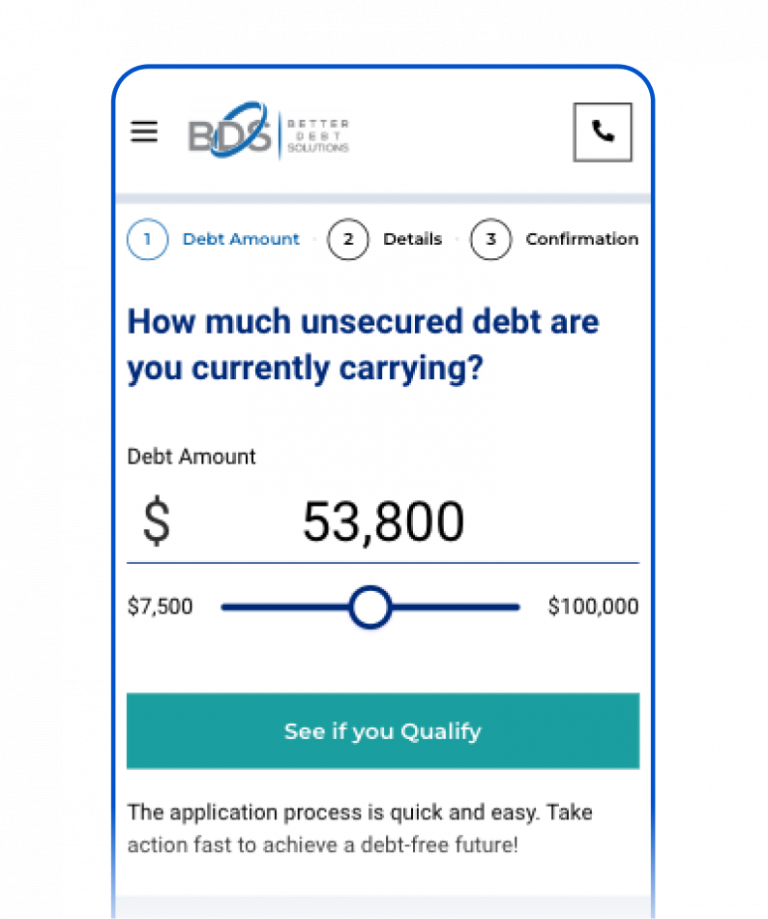

Alternatives to Bankruptcy

Financial difficulties can be overwhelming, and while bankruptcy might seem like the only way out, there are other alternatives that individuals can consider. Among the most popular options are Debt Consolidation, Debt Settlement, and Credit Counseling. Each offers its own advantages and considerations.

Debt Consolidation

Debt Consolidation is a financial strategy that involves taking out a new loan to pay off multiple existing debts, ideally at a lower interest rate. This approach simplifies debt management by consolidating various payments into a single monthly installment, which can lead to cost savings and expedite debt repayment. However, it’s crucial to understand the loan’s terms fully, and there is a risk of falling further into debt if poor spending habits persist post-consolidation.

Debt Settlement

Debt Settlement is a financial strategy where you negotiate with creditors to accept a payment lower than the total amount owed, thereby settling the debt for less. This approach can offer significant financial relief, as it allows you to resolve debts without paying the full sum, freeing you from further obligations to that creditor. However, it’s important to note that debt settlement can have a negative impact on your credit score and the amount saved may be considered taxable income by tax authorities.

Credit Counseling

Credit Counseling is a service usually offered by nonprofit agencies that helps individuals manage their money and debts more effectively. The agencies often collaborate with creditors to establish a debt management plan (DMP) for the debtor, which can lead to benefits such as reduced interest rates, waived fees, and a structured, more manageable payment plan. While the counseling itself doesn’t harm one’s credit score, closing accounts to participate in a DMP might. It’s crucial to ensure the agency is reputable, ideally by verifying their accreditation by a recognized organization.

Conclusion

Bankruptcy, though challenging, is not the end of one’s financial story but a chapter in it. With the right knowledge and support, recovery and financial rebirth are possible. Whether considering bankruptcy or seeking alternatives, remember that professional advice is invaluable. Your financial future is a book yet to be written, and with the right steps, it can be a story of resilience and triumph.